DORA Proportionality: Right-Sizing Compliance for FinTechs

DORA Proportionality made practical: CTO roadmap to tailor ICT risk controls, automate incident reporting, and streamline third-party oversight for audits.

How to Master DORA Proportionality: A CTO’s Practical Guide

1. Know the Legal Bedrock

Recital 36 — The Intent

“Financial entities shall put in place and maintain resilient ICT systems taking into account the nature, scale and complexity of their services, activities and operations, as well as their overall risk profile.”

Share this exact wording whenever someone treats DORA as a one-size-fits-all rulebook.

Article 4 — The Mandate

Supervisors must assess compliance “in a proportionate manner,” weighing:

nature, scale and complexity of services

overall risk profile

potential impact on customers and markets

Article 16 — The Safety Valve for Micro & Small Firms

Entities with fewer than 10 staff and an annual turnover below €2 million may use a simplified ICT-Risk Management Framework (ICT-RMF). They are exempt from Articles 5–15 (including TLPT) provided they maintain basic security-by-design controls and an incident log.

Quick Win — Circulate the Excerpts

Create a two-page brief containing Recital 36, Article 4 and Article 16; highlight key phrases and send it to executives and legal counsel before budget talks.

Mini-Checklist for CTOs

Recital 36 archived in the policy wiki

Excerpts included in the next board deck

Internal FAQ entry: “Proportionality is built into DORA—see Recital 36, Art. 4 & 16”

2. Profile Your Size-Risk Matrix

Why Start Here?

Regulators expect an up-front self-assessment. Skipping it invites over-engineering—or blind spots.

Step-by-Step Mapping

List core assets — systems, code repos, on-prem hardware, SaaS.

Capture transaction volumes — daily payments, peak API calls.

Mark geographic scope — customer countries, data-centre locations.

Identify critical functions — activities whose failure halts payments, trading or onboarding.

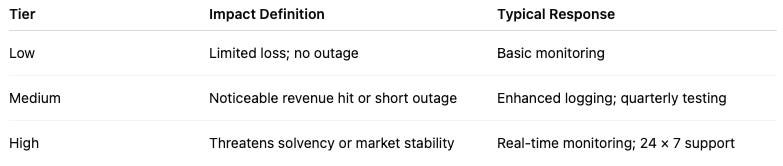

Classify Impact Tiers

Mini-Checklist

Matrix covers 100 % of production assets

Impact tier agreed by two + stakeholders

Reviewed quarterly or after material changes

3. Governance Guard-Rails (Article 5)

The board remains ultimately accountable for ICT risk:

An accountable executive (CTO, CIO or COO) is formally appointed.

The three lines of defence model is respected: operations, risk-control, and internal audit.

The board approves and publishes the underlying assumptions of the size-risk matrix every year.

Mini-Checklist

Board minutes reflect an annual ICT-risk review

First- and second-line roles separated by policy or contract

4. Tailor Your ICT-RMF (Article 6)

Article 6 demands an ICT-Risk Management Framework but explicitly allows scalability based on “size, risk profile and business complexity.” You can extend existing cyber- or operational-risk processes instead of starting from scratch.

Reminder: If you qualify for Article 16, the entire framework can often be compressed into a single 10–15-page integrated policy.

Minimum Viable Controls Every CTO Must Evidence

Even the leanest ICT-RMF must demonstrably cover the six NIST-style functions:

5. Scale Incident Reporting (Articles 19–20)

Match the Clock to Your Size

The final RTS (17 July 2024) sets strict windows:

4 hours after designating an incident as major — initial notification

24 hours after detection — if classification is still pending

If a deadline falls on a non-business day, most entities (except significant/systemic ones) may report by 12:00 on the next working day

Automate Severity Mapping

A rules engine that weighs service impact, customer reach, and data loss can instantly tag incidents as major or significant, ensuring only genuinely major events trigger the 4-hour clock.

Keep One Taxonomy — DORA, GDPR, NIS2

Align labels so one incident equals one record. The Commission explicitly encourages converged taxonomies.

6. Calibrate TLPT & Testing (Article 26)

Document your rationale and keep evidence for auditors.

7. Streamline Third-Party Oversight (Articles 28–31)

Quick Risk Triage

List all external ICT services.

Score criticality: core, important or supporting.

Scale due diligence accordingly.

Risk-Based Due Diligence

Mandatory Contract Clauses (Article 30 § 2)

Every contract covering a critical or important service must include:

audit and inspection rights

conditions for sub-outsourcing

data location and portability requirements

incident-notification timelines

exit and transition plan

8. Evidence Your Decisions

Regulators want the logic behind scaled controls. Annotate each control with its link to the size-risk matrix and refresh documentation quarterly. All controls must be fully in force or explicitly scheduled.

9. Tap Guidance & Peers

Reg-Tech sandboxes, industry round-tables and peer benchmarks are excellent ways to pressure-test proportionality decisions before audits.

10. Build a Three-Year Maturity Roadmap

KPIs should track impact (e.g., MTTR on critical services) rather than headcount.

Final Tip — One-Control Sprint (4 Weeks)

Pick a single high-impact control, map it to DORA’s proportionality wording, right-size it and document your rationale. Repeat quarterly; proportionality will soon become muscle memory.